By: Joe Keenan, Global Managing Director: Industrial Fluid Flow Solutions at RMI Pressure Systems

As players in the highly competitive global pump sector move from a ‘product’ to a ‘system’ focus to differentiate themselves, the most successful efforts are likely to be those that impact directly on customer’s cost imperatives and their environmental, social and governance (ESG) priorities.

The global industrial pumps market – which by some estimates is worth around US$70 billion a year – continues to grow rapidly, at an annual compound rate of 4-6%. On the average industrial site, it is likely that pumps account for some 30% of the total energy consumed. At the same time, it is acknowledged that the vast majority of pumps operate at low efficiencies – wasting money and generating unnecessary volumes of carbon dioxide.

Addressing these energy inefficiencies should therefore be a priority for the growing pump sector, as such initiatives feed strategically into customers’ commercial and ESG imperatives. An important way of doing this can be seen in the shift away from a purely product offering – and towards broader system-based solutions for customers. Such a shift also presents opportunities for brand differentiation, in a market that has become increasingly commoditised.

Pump designers and manufacturers must respond to customers’ pressing needs, such as equipment longevity and reliability.

In pursuing this differentiation, designers and manufacturers of pumps need to respond to their customers’ pressing needs in their specific applications. A key differentiator, for instance, is for equipment to last longer and perform more reliably, which for many customers is a vital bottom-line requirement.

Climate change and global conflicts

With climate change and the current geopolitical instability, though, have come other important prerogatives that define value for customers – especially those in energy-intensive sectors such as mining and steelmaking. For industries like these, ESG is now becoming a central element in strategy and branding, demanding more efficient use of energy in production – especially as gas and power costs surge in the wake of the Ukraine conflict.

Many large customers are therefore looking to reduce their carbon footprint and operating costs by using less energy, while at the same time also conserving water as an increasingly precious natural resource. Responding to these needs should therefore be front-of-mind as pump specialists embrace system thinking to enhance their offerings.

Into the systems space

While pump OEMs must continuously improve technical aspects of their equipment, there are invariably diminishing returns on these gradual enhancements. The more comprehensive and significant trend is beyond the realm of the product, and into the systems space. Here, the pump is one component among others within a system that aims to solve multiple customer requirements, not just one.

By way of illustration, a pump user would traditionally procure a pump for a certain purpose, and would need the in-house expertise and infrastructure to install, monitor, maintain and service that equipment. This requires specialised knowledge about how that pump is applied in that specific application – or system – in order to ensure that the pump delivers the value required to warrant its purchase price.

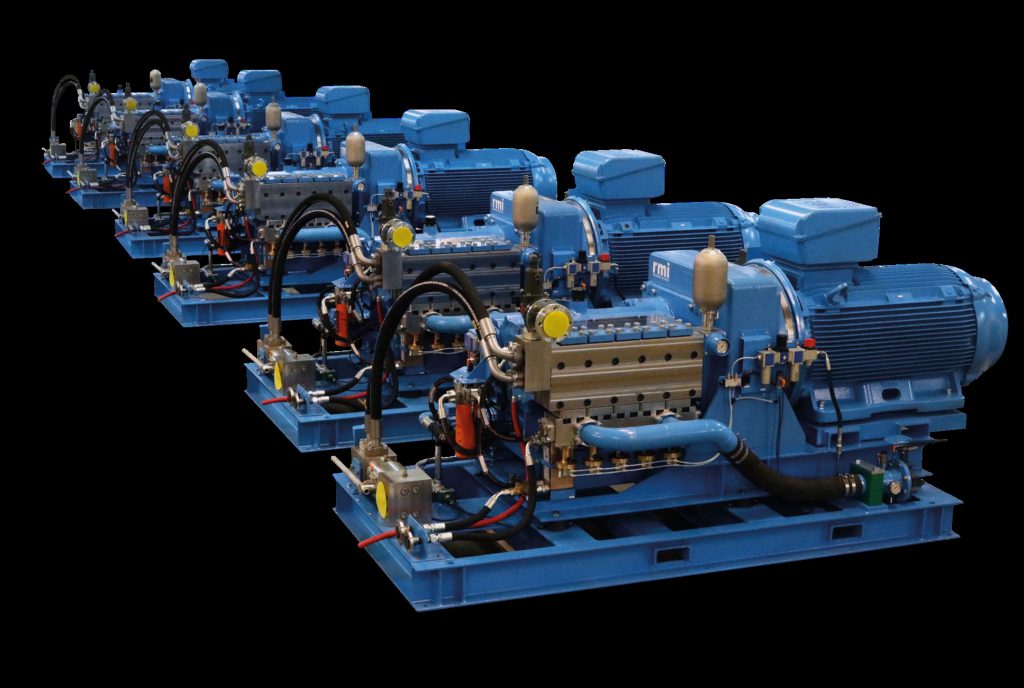

A market shift occurs when a pump supplier begins to augment its offering with the other components or accessories that the customer has previously had to procure themselves. It could even occur through corporate acquisitions of upstream or downstream ‘phases’ of production, allowing the customer to source more of their operational equipment from a single supplier.

Lessons from EVs

The significance of system offerings as a disruptive strategy was recently highlighted in the process of developing and marketing electric vehicles (EVs). With innovative battery technology as the enabling innovation behind the EV revolution, what we have essentially witnessed is a vehicle being constructed as a ‘system’ around a battery. This process has not only provided customers with a differentiated product but has created a new trajectory for the motor industry.

The recent experience of the burgeoning EV industry holds some nuggets of wisdom for all sectors, not least the well-established pump business. Two insights stand out for those companies wanting to grow their offerings from stand-alone products to systems. The first is focus: businesses can seldom be good at everything, so they need to decide where exactly their energies and resources are best directed. The second is building the knowledge base: a system solution invariably means moving downstream into aspects of the customers’ operation for which they – or another supplier – were traditionally responsible.

More responsibility

This means learning more about what the customer already knows, to essentially assume more responsibility for their process. The next important strategy is to harness the power of technology for this new system, to improve monitoring, leverage operational data, predict maintenance requirements and raise uptime levels. In the pump sector, there is significant progress here and potential to do more, including the increased use of variable speed drives to conserve both energy and water.

For those companies with the insights and resources to successfully move forward on this basis, there is considerable benefit. They move themselves into a less crowded trading space, as the barriers to entry are likely to prevent most of their previous competitors from following. Most importantly, it situates the firm in a different relationship to customers – where the conversation moves away from products and their features, to outcomes and their value.

Collaboration

For the customer, the conversation is now elevated to a level where their key performance indicators (KPIs) – including compliance with ESG standards – can be discussed. The supplier becomes the service provider, and takes an active role in helping the customer achieve these KPIs – through systems that include pumping equipment but are judged – and sold – on different terms.

In this sense, the strategic shift into the realm of systems and solutions must keep pace with the changing imperatives that drive customer decision making, turning the supplier relationship into even more of an ongoing collaboration.

Recent Comments